Which is the Best CPF LIFE Plan for You?

Many Singaporeans have heard of CPF LIFE, but don’t quite understand what it is. Today we will break it down and give you some tips on how to decide which is best CPF LIFE Plan for you.

What is CPF LIFE?

The CPF Lifelong Income For The Elderly (CPF LIFE) Scheme is a life annuity scheme that provides Singapore Citizens and Permanent Residents with a monthly payout for as long as they live.

What are the Types of CPF LIFE Plans?

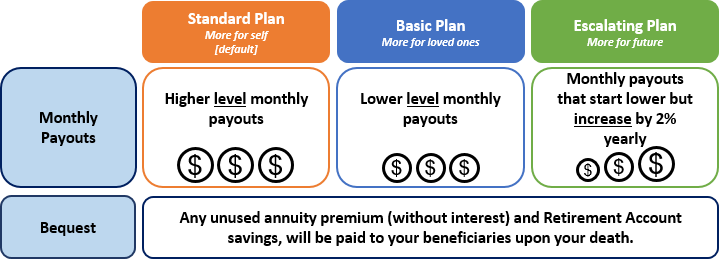

There are 3 Types of CPF LIFE Plan

- Standard Plan

- Basic Plan

- Escalating Plan

Source: CPF.gov.sg

Which is the Best CPF LIFE Plan for You?

Here’s a YouTube video on what Singaporeans think of this question.

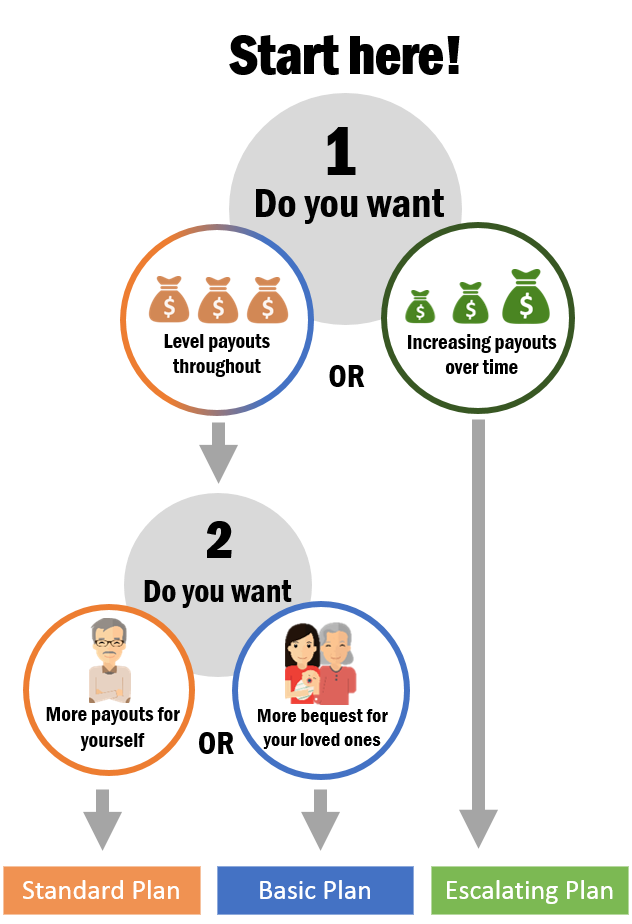

And here’s an infographic on how to choose your CPF LIFE Plan.

Source: CPF.gov.sg

At the end of the day, the best CPF LIFE Plan for you depends on your own retirement needs.

How much must you contribute to get a CPF LIFE payout of $2,000/month?

Most people think their expenses during retirement will be about $2,000/month.

To get the estimated amount you need to contribute to CPF to get CPF LIFE payout of $2,000/month, you can use the CPF LIFE Payout Estimator: https://www.cpf.gov.sg/eSvc/Web/Schemes/LifePayoutEstimator/LifePayoutEstimator

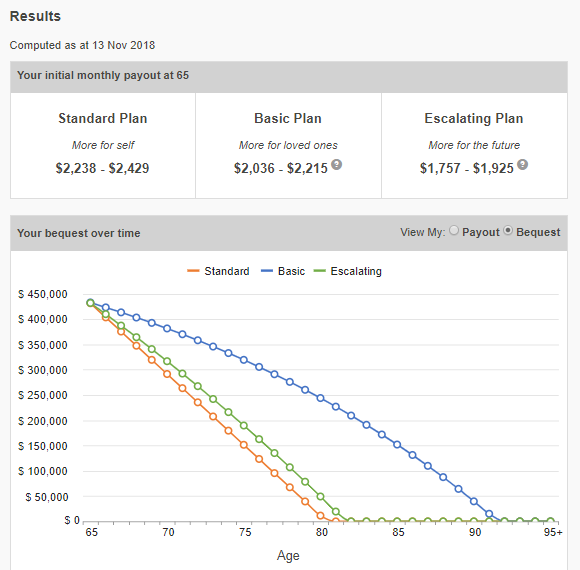

Based on my input below:

- Gender: Male

- Date of Birth: 01 Jan 1960

- Current Retirement Account Balance: $350,000

- I would like to start my payouts at age: 65

Here are my results:

As you can see from the example above, if I am a male guy born in 01 Jan 1960, and want CPF LIFE payout of $2,000/month starting from age 65, I must contribute about $350,000 to my CPF (Retirement Account) if I choose the CPF LIFE Basic Plan.

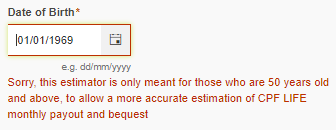

While the CPF LIFE Payout Estimator is a great tool for getting an estimate, there’s a problem… it doesn’t allow you to key in a date of birth that’s below 50 years old. If you’re below 50 years old and want to plan ahead for CPF LIFE, this tool will be less useful.

It is also important to note that CPF LIFE is just one scheme for retirement planning; and should not be the only thing you rely on. To get more comprehensive retirement planning, we strongly encourage you to talk to an experienced financial planner so that he/she can work out your financial numbers and help you achieve your retirement goals.

Leave a Reply

Want to join the discussion?Feel free to contribute!