The Importance of Retirement Planning in an Ageing Society

One of the major challenges faced by Singapore, is having an Ageing Population.

The Singapore Department of Statistics has been tracking the old-age support ratio.

It relates to the number of people who are capable of providing economic support to the number of older people who may be dependent on others’ support. It is computed as the ratio of the working-age population (e.g. aged 20-64 years) per person aged 65 years and over in Singapore.

Over the past decades, the old-age support ratio of the resident population (comprising Singapore citizens and permanent residents) has steadily decreased.

Source: SingStats.gov.sg

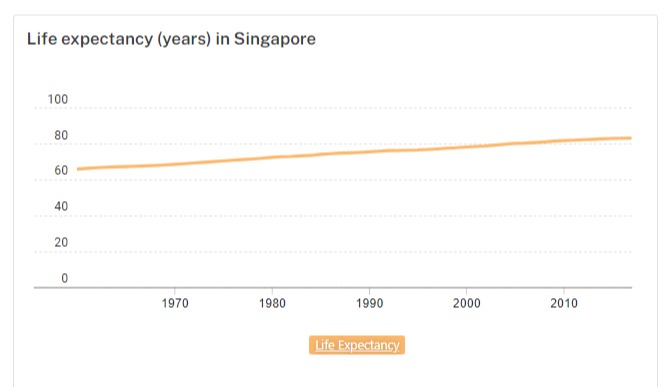

Factors contributing to this downward trend include rising life expectancy and falling birth rates.

Rise of the Sandwich Generation

Sandwich Generation refers to people who financially support and care for older and younger family members at the same time.

Most of those in the sandwiched group would be working individuals between ages 20 and 64. However, there are cases of retirees in their 60s and 70s who are caring for their children and grandchildren, as well as their elderly parents.

This is partially due to the increasing life expectancy of Singaporeans, as they have access to world-class health care facilities.

Source: worldbank.org

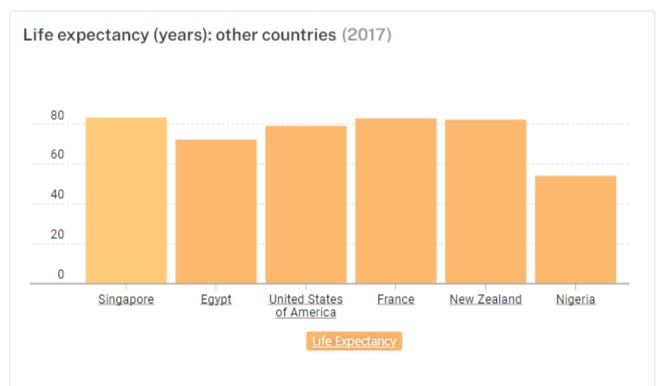

Singapore is one of the countries with the highest life expectancy in the world.

Source: worldbank.org

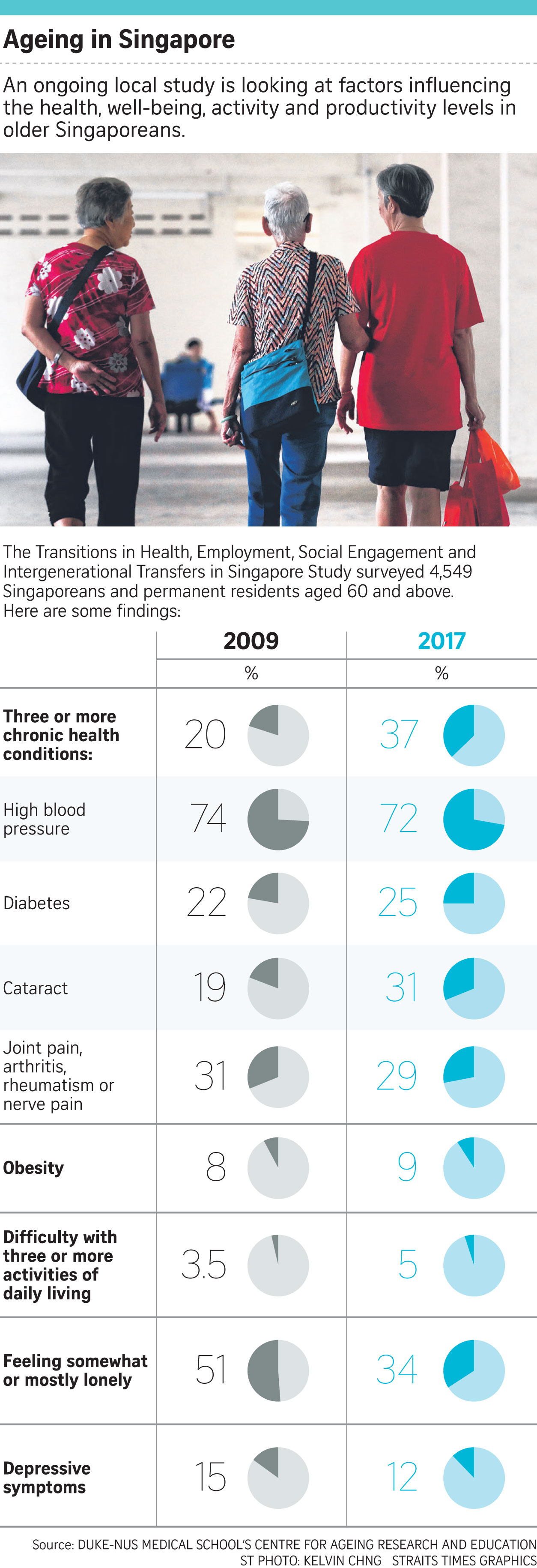

Unfortunately, even though Singaporeans are living longer, many spend their twilight years in poor health.

A Straits Times article mentioned that a local study has found that, the proportion of older adults with three or more chronic diseases nearly doubled from 2009 to 2017.

The article also stated that based on an ongoing survey of more than 4,500 Singaporeans and permanent residents, more Singaporeans aged 60 and above are also having difficulty carrying out daily living activities.

Source: StraitsTimes.com

What if you belong the Sandwich Generation?

If you do not have wealthy parents who don’t require your financial support, you may need to assist them in their retirement planning.

Although Singapore has several national schemes such as CPF Life, MediShield Life, CareShield Life, you should not assume that your parents have sufficient retirement funding and insurance coverage; because it will depend on their financial and health situation.

Leave a Reply

Want to join the discussion?Feel free to contribute!