Should You Invest In REITS

REIT is a popular choice for investors because it can be used for long-term investment, as well as short-term trading.

REIT FOR LONG-TERM INVESTING

The reason why REIT is suitable for long-term investment is because by law, 90% of the net income from a REIT must be re-distributed back to shareholders as dividends.

A REIT may distribute dividends up to 4 times per year. If investors build a portfolio of REITs with strong performance, they can potentially generate a predictable stream of dividends every quarter or even every month.

Furthermore, Singapore REITs can distribute more dividends than overseas REITs because of tax exemption, and may also benefit from capital gains like a regular stock.

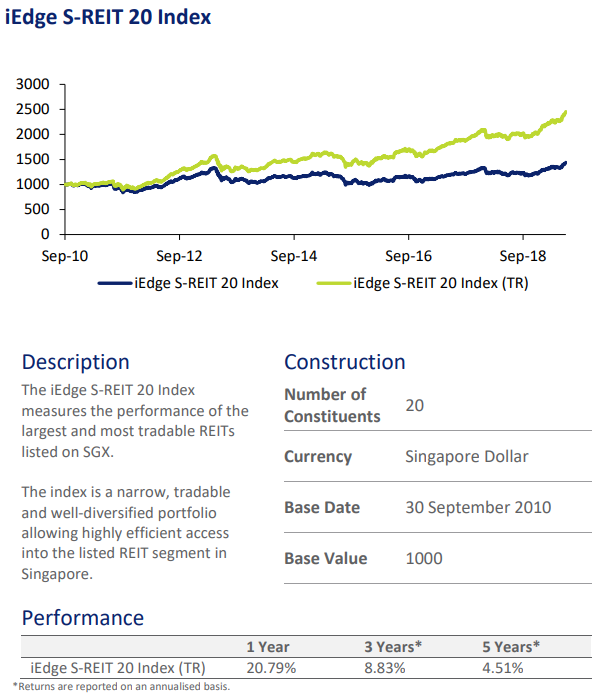

Most local REITs investors aim for 5-10% dividend yield annually. In recent years, REITs like the iEdge S-Reit Index have outperformed that expectation.

Source: SGX Factsheet

REIT FOR SHORT TERM TRADING

Unlike long-term investors, short-term traders usually aim to profit from capital gains within a few weeks or months. This is usually done with a Buy Low Sell High or Buy High Sell Higher strategy (for bullish market) using technical analysis.

However, these strategies usually involve higher risk. If the price trend unexpectedly reverse from uptrend to downtrend, the trader must be prepared to sell to cut loss if necessary.

CONCLUSION

It is also important to understand the difference between investing and trading, and picking the strategy which suit your risk tolerance.

Having a good knowledge of Fundamental Analysis, and Technical Analysis also helps.

REITs is one of financial instruments you can consider adding to your investment portfolio.

Leave a Reply

Want to join the discussion?Feel free to contribute!